Earned Income Tax Credit for the Spousal Support Recipient

The IRS provides an Earned Income Tax Credit to provide a tax break to low – moderate income earning families. Recently, there have been changes to federal tax law that may allow you to claim this benefit even if you did not qualify for it previously. For example, if your ex-spouse earned higher income and you filed joint tax returns during your marriage, you may not have been eligible for this tax credit. Once your divorce is finalized or after a physical separation of more than six months, you may file single or head of household, and the IRS will look only at your income to determine eligibility. Prior to the new law, a taxpayer who was otherwise eligible for the Earned Income Tax Credit could be barred from receiving the credit if he or she also received spousal support.

Under the Tax Cuts and Job Acts of 2017, spousal support is no longer taxable as income for the recipient spouse on his or her federal tax return if the divorce was finalized on January 1, 2019, or later. See this article for details about this new law. If your divorce was finalized after this date, depending on your other sources of income, if any, you may qualify for the Earned Income Credit since you do not have to include your spousal support payments as income.

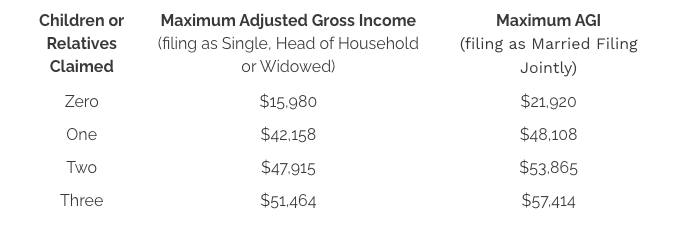

The Earned Income Credit is only available if your Adjusted Gross Income (“AGI”) is within the parameters set by the IRS for each tax year. The AGI limit increases depending on the number of qualifying children claimed on your return. Additionally, you cannot receive investment income in excess of $3,650, and the credit is not available if you file as Married Filing Separately. For the 2021 Tax Year, the AGI limits are as follows:

Source: https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit/earned-income-and-earned-income-tax-credit-eitc-tables, last updated May 11, 2021.

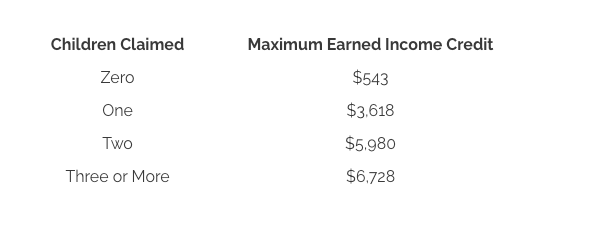

The total amount of the credit increases with each dependent claimed but is capped at three or more dependents. If your ex-spouse is claiming your child on his or her tax return, you cannot claim that same child for the purposes of the Earned Income Credit that year. For the 2021 Tax Year, the maximum credits are as follows:

Since spousal support payments are not included as income, now it is easier for the low to moderate earning spouse to qualify for the Earned Income Credit after the divorce. Additionally, since the ability to claim the credit and the amount is directly affected by the number of qualifying children claimed, it is important to consider the allocation of the right to claim your dependent children when determining the terms of any negotiated settlement or requested relief from the Court.

Your attorney can help you navigate the process of ending your marriage, including considering the future tax implications related to your children and spousal support.